WorldSharp W-2 Preparation System

Click on images to the left to enlarge them.

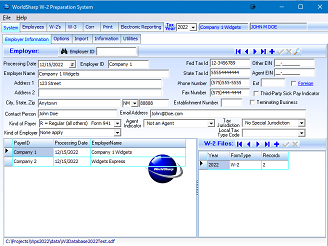

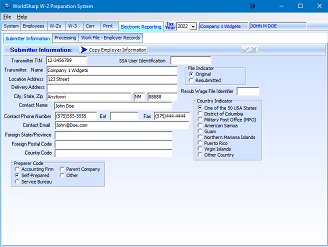

Main Screen - System/Employer Information

This is the main screen of the WorldSharp W-2 Preparation System. It has tabs across the top and some of the tabs have additional tabs under them. You may click on the images to the left to enlarge the screen images.

This is the screen used to enter the Employer information. The grid will have a row for each employer. Once the employer is entered or selected, all other screens will have information for that employer. For a company, there might be only one employer, but for a CPA firm, there might be many employer records.

This screen allows the user to set the Tax Year. Setting the Tax Year is normally not required unless forms for previous years are being processed.

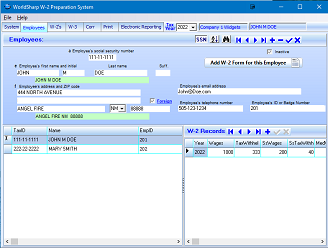

Display/Entry Employees

The employees are entered with the fields that are required for a W-2 form. The employee records can be accessed in SSN or Alphabetic order. Additional fields that help manage the process are email address, phone number and Employee ID or badge number. There is a provision for entering a foreign address.

There is a button to allow a W-2 form to be added for the employee.

A grid showing all of the W-2 forms that have been added for the employee. If a W-2 in the list is clicked, the system will show the details of the W-2.

A grid on the lower left lists all of the employees for this employer.

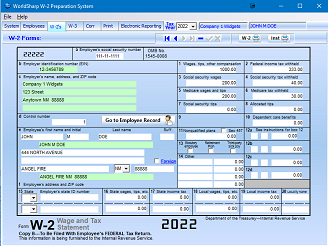

W-2 Display/Entry

When the W-2 is added from the employee screen, the W-2 will already have the employer and employee information included. The amount fields may now be entered. The fields are in approximately the same location as they are on the standard IRS W-2.

There are buttons to print a single W-2 form and the instructions sheet.

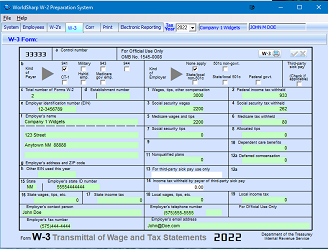

W-3 Display/Entry

Most of the fields required for the W-3 form are automatically calculated and entered. There are a couple of fields that you will need to enter if they apply to that W-3.

There is a button to print the W-3 form.

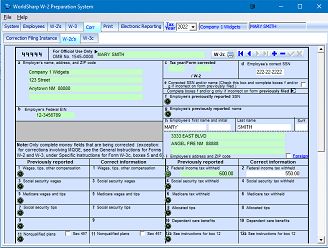

W-2c Display/Entry

The W-2c form is used to make corrections to a W-2 that you have already provided to an employee. The W-2 that requires correction is located in the W-2 Screen. Then when the '+' is pressed on the navagation bar in the W-2c screen, the information for that W-2 will be available.

To make corrections, the green LED is pressed in the box or boxes that require correction. The amount from the original W-2 will appear on the left side of that box. Then the correct amount is to be entered on the right side of the box.

There is a button to print the W-2c form.

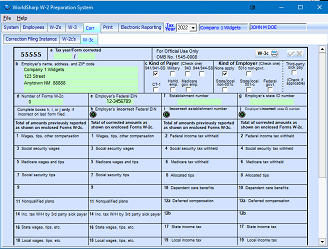

W-3c Display/Entry

When W-2c forms have been entered, the system will calculate automatically and place the appropriate information in the fields on the W-3c form.

There are some non-monitary fields that might need to be changed. In those cases, press the green LED in the box needing correction and enter the correct information.

There is a button to print the W-3c Form.

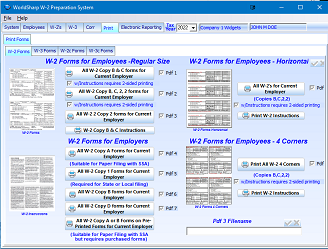

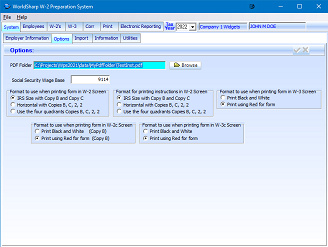

Print W-2 Forms

There a number of formats of W-2 forms that can be printed. There is the regular size (which is the one that the IRS provides) which is one half of a page. These can be printed in a variety of ways. The standard way is printing on one page with the Copy B on the top and Copy C on the bottom. They can be printed with instructions on back(requires a printer that prints on both sides. They can be printed to a PDF.

They may be printed 4 horizontal forms (copies B, C, 2, 2).

They may be printed 4 forms one on each corner (copies B, C, 2, 2).

They may be printed on Pre-printed forms.

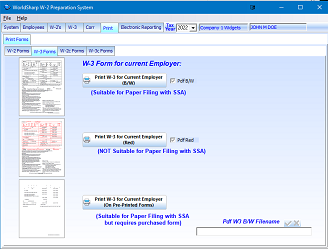

Print W-3

The W-3 can be printed in black and white, red or on preprinted forms.

It can be printed to a PDF.

Electronic Reporting Section

A file suitable for submitting to the Social Security Administration can be created. If the submitter information is to be the same company and the employer, there is a button that will copy the employer screen to the submitter screen/

The other tabs in this section are where the file is created and submitted.

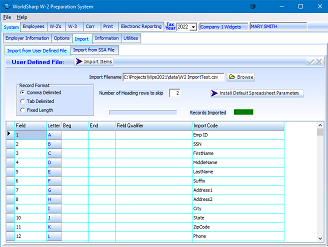

W-2 Importing

Instead of entering the W-2 forms, the information may be imported from a csv file.

A template is provided that will have columns for each field required for importing W-2 information. Using the template allows the operator to press a button to set all of the parameters. However any arangement of the fields can be used if the operator wants to enter the parameters.

System/Options

Some processing options are set on this screen. Different formats are allowed for printing some of the forms. Those can be set on this screen. When printing forms, some can be sent to a PDF. This screen is where the folder location for the PDF files will be placed.